August 2023

By Mario Nardone, CFA, and Eric Stein, CFA

Note: This is only a preview; East Bay clients have full access to the piece.

Let us begin by defining the two sources of investment returns:

- Capital appreciation, which is an increase in the value of the investment itself, and

- Income (or “yield”), which represents payments made to the investor during the holding period, such as dividends in the case of stocks, or coupon payments for bonds.

For investors in the accumulation stage, and especially where taxes are not a factor, most are indifferent as to whether their returns come from capital appreciation or income, as long as return (or risk-adjusted-return) is maximized. Yet, when investors move into the decumulation or spending stage, some prefer to spend only the income and have an aversion to tapping into the principal to fund their spending needs. If the annual withdrawal rate is low enough, say 2% of the total portfolio value, and assuming the portfolio holds enough stocks or other appreciable assets to combat the impact of inflation, this may be plausible given typical stock and bond yields.

However, many investors try to draw as much as possible from their portfolio, and if their withdrawal rate is too high, trying to satisfy their annual needs with income alone can lead to problems. After considering the tradeoffs of investing for income versus appreciation, we believe that a combination of the two, the “Total Return Approach,” is most appropriate.

Examining the income-only approach

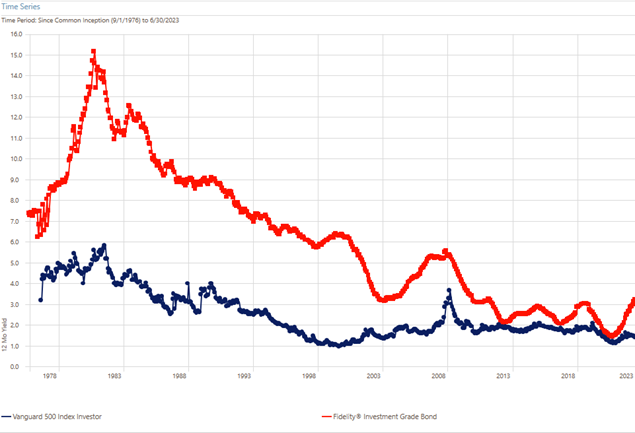

For savers and investors with experience dating back to the 1970’s and 80’s, they may recall an era when income yields on bonds and dividend yields of stocks each exceeded 5%. Simply “clipping the coupon” off their bonds and cashing their dividend checks produced an attractive income stream. Figure 1 shows the general decline in yields of stocks and bonds since that era, using two popular mutual funds with long histories and consistent strategies as reference points.

Figure 1

Source: Morningstar Direct

At today’s bond yields of around 3.5% and stock dividends around 1.5%, it is clear that investors requiring a 5% return would not meet their needs with the income alone from a diversified portfolio of investment-grade bonds and large-cap US stocks. Investors with an aversion to selling off assets (i.e. “tapping into the principal”) to accommodate their income needs often look to a number of options for boosting portfolio yield:

Option 1: Increase the Portfolio’s Allocation to Bonds

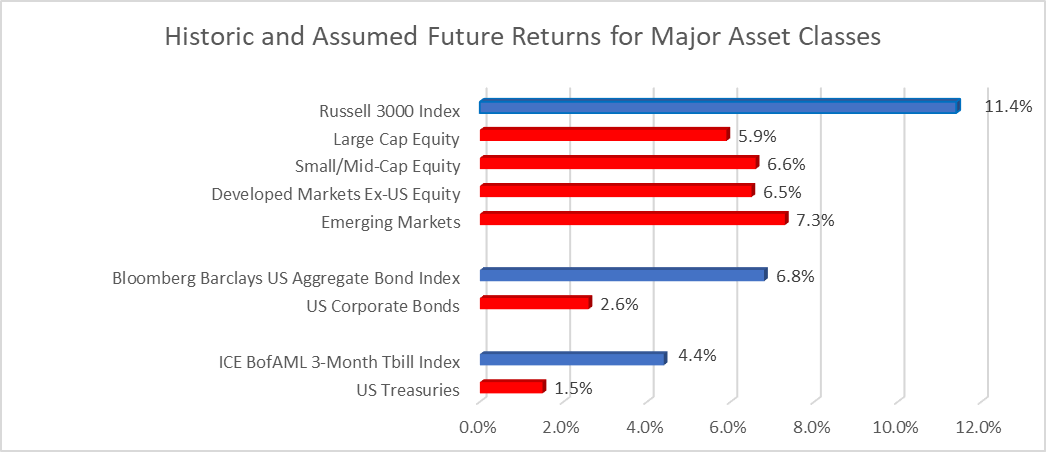

We believe that the most important decision in investing is choosing an appropriate allocation of stocks, bonds, cash, and other asset classes, based on the investor’s required rate of return and tolerance for risk. While increasing the portfolio’s weight in bonds may increase its current income, the lower total return on bonds will reduce the portfolio’s long-term expected return, and thus the probability of meeting the investor’s goals and keeping pace with inflation. Figure 2 shows the average annualized returns of US stocks, US bonds and a proxy for cash dating back to 1980, as well as capital market assumptions. Using sound logic and either set of data as a guide, it is evident that increasing the bond allocation would reduce long-term expected returns.

Figure 2

Blue bars reflect Historical Returns 2/1/1980-6/30/2023 from Morningstar Direct; Red bars reflect Average Expected Returns for the next 10 years based upon the 2022 Horizon Actuarial Services Survey

This is only a preview; East Bay clients have full access to the piece.

For busy financial planners interested in spending more time with clients, we provide quarterly market updates of this nature which you may white-label and distribute. You get to spend more time doing what you enjoy while your clients stay up to date with high-quality investment analysis.