Note: This is only a preview; East Bay clients have full access to the piece.

When creating a diversified portfolio, it’s common to include U.S.-based stocks as well as stocks from developed and emerging market nations. What’s not so common is to see that same globally diversified approach on the fixed-income side of the equation, or more specifically, having a dedicated allocation to emerging markets debt (EMD). This piece will highlight the various types of EMD that exist, some of their potential benefits as well as risks, and whether a place for EMD exists in a portfolio.

The Three Main Types of EMD Investing

There are three primary ways to invest in EMD including sovereign local currency debt, sovereign hard currency debt, and EMD corporate debt. As we review these options below, keep in mind that some asset managers will blend the various approaches, which creates further opportunities for investment.

Sovereign Local Currency Debt: Countries that have some currency stability and obtained a degree of market size and maturity can issue sovereign bonds in their own currency. Only higher-quality countries are typically able to issue their own debt, so the average credit quality of the index is currently investment grade, though near the lowest rung of the investment grade ladder. Because the bonds are issued in local currency, however, their returns are subject to currency risk and currency volatility.

Sovereign Hard Currency Debt: For countries that do not have stable currencies and/or do not have sizeable or mature markets, their sovereign debt is issued in US dollars. Because of this, investors don’t have the same currency concerns as they would with local currency debt. However, because the emerging countries issuing this type of debt are less economically sound, their average credit quality may be below that of local currency EMD (two of the three rating agencies consider this index below investment grade, one considers it investment grade).

EMD Corporate Debt: Rather than consisting of sovereign bonds like the two other types of EMD indexes, this index represents bonds issued in US dollars by companies based within these emerging market countries. Similar to hard currency, investors don’t have to worry about currency concerns with local debt. Unlike hard currency bonds, however, all three rating agencies categorize this index overall as being investment grade on average, though towards the lowest rung of the investment grade ladder.

How Large Is the EMD Opportunity Set?

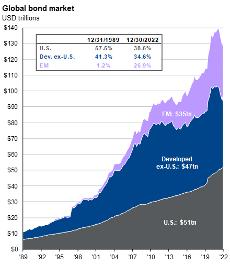

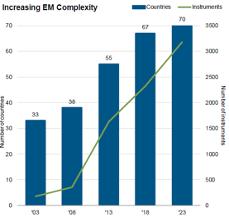

As Exhibit 1 shows, EMD has been a growing part of the global bond market, representing almost 27% at year-end 2022 vs. just over 1% in 1989. Similarly, Exhibit 2 shows that the growth in EMD has come from the number of countries issuing bonds plus the number of instruments being issued.

Exhibit 1

Source: J.P. Morgan Asset Management; BIS. Global bond market regional breakdown may not sum to 100% due to rounding. As of June 30, 2023

Exhibit 2

Source: PIMCO, JP Morgan, data as of March 31, 2023. Number of countries refers to the JPM EMBI Global Diversified Index; Number of instruments is an aggregate of the 3 flagship JPMindices: JPM EMBI Global Diversified, JPM CEMBI Broad Diversified, and GBI-EM Global Diversified.

What Makes EMD Attractive to Investors?

Based on historical performance, there is evidence to suggest that adding EMD to a fixed income allocation may provide added return, as long as investors are willing to accept higher levels of risk. EMD has some characteristics of high-quality bonds (e.g. they are on the lower end of the investment grade spectrum), but they also come with their unique risks including country risk, political risk, currency risk (local EMD), and other risks associated with investing in emerging market countries.

This is only a preview; East Bay clients have full access to the piece.

For busy financial planners interested in spending more time with clients, we provide quarterly market updates of this nature which you may white-label and distribute. You get to spend more time doing what you enjoy while your clients stay up to date with high-quality investment analysis.